does idaho tax pensions and social security

Idaho is tax-friendly toward retirees. Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits.

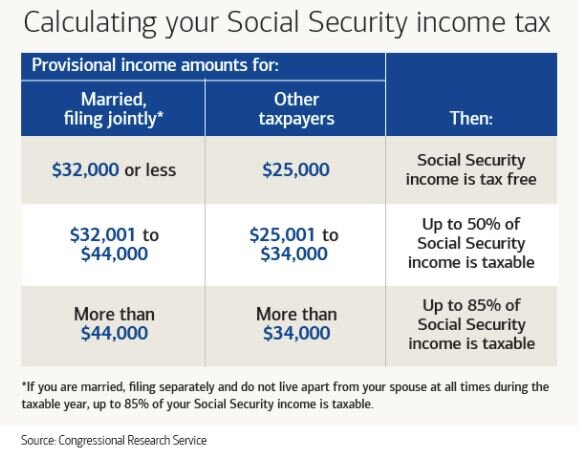

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Up to 85 of Social Security benefits are taxable for an individual with a combined gross income of at least 34000 or a couple filing jointly with a combined gross income of at least.

. Those contribution rates are set by the state legislature and can change year-to-year. As they work teachers and their employers must contribute into the plan. Hawaii does not tax Social Security benefits.

Does idaho tax social security. 52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. Does federal government tax Social Security.

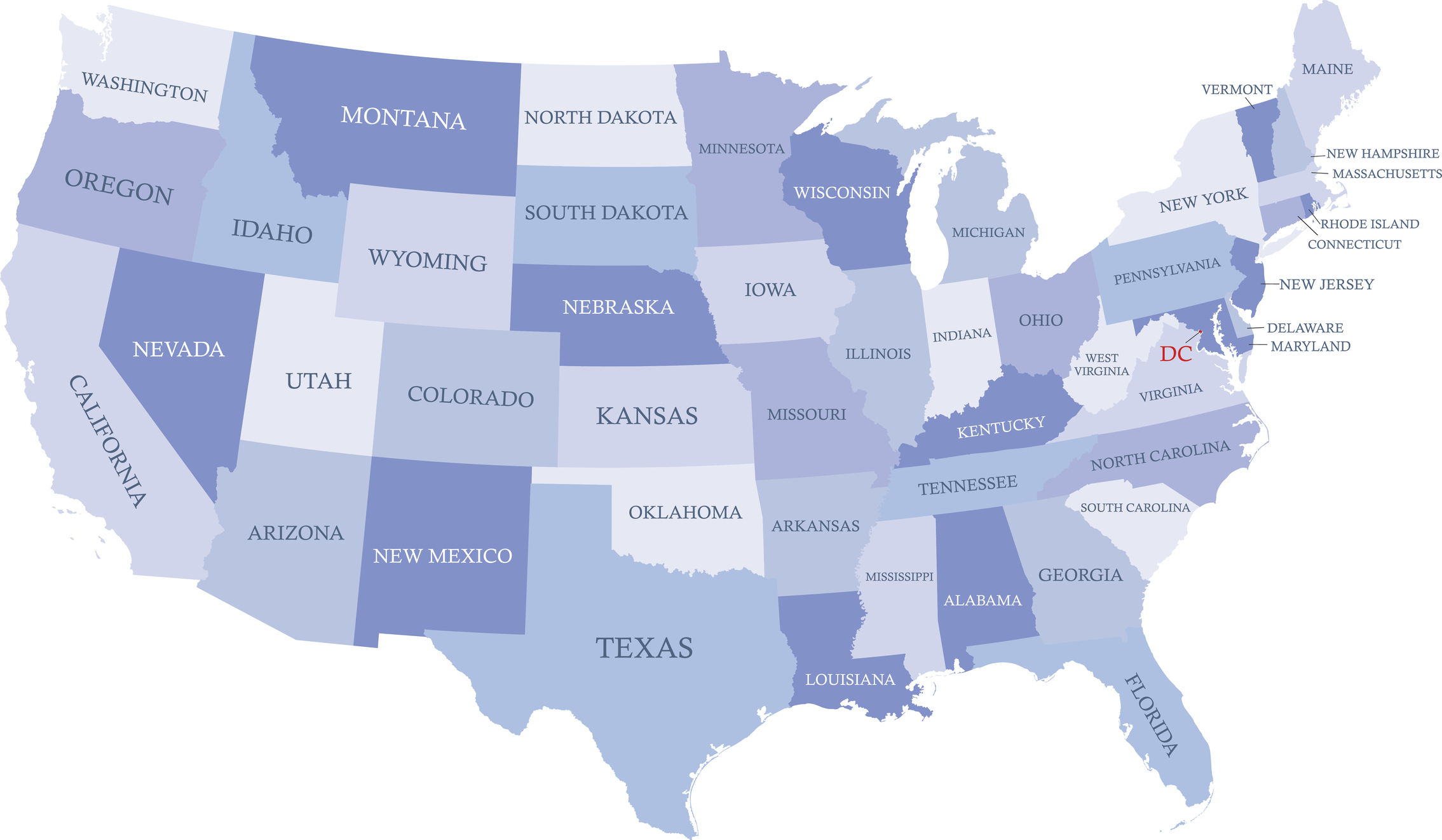

We have guides to help you learn more about Idaho Residency Status and Idaho Source Income. The rule is subject to phaseouts starting at incomes of 80270 for joint married filers. Alaska Nevada Washington and Wyoming dont have state income taxes at all and Arizona California Hawaii Idaho and Oregon have special provisions exempting Social Security benefits from state taxation.

Now that they are collecting Social Security the tax calculation requires an extra step. However according to Idaho instructions Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. The state allows a subtraction from benefits ranging from 2645 for married taxpayers who file separately to 4130 for single taxpayers to 5290 for married taxpayers who file jointly.

Even though the pension income is from an Idaho source federal law prevents Idaho from taxing it. 800-732-8866 or Illinois Tax Department Exclusion for qualifying retirement plans. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires.

How Much Does Idahos Teacher Pension Plan Cost. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. 800-972-7660 or taxidahogov Retirement Benefits exclusion.

Pension from out-of-Idaho job now moved to Idaho. Some states with low or no income taxes have higher property or sales taxes. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return.

The 20 Worst Places to Live in Idaho Post Does Idaho tax Social Security. Minnesota partially taxes Social Security benefits. She became a resident of California and receives pension income from a job she had in Idaho.

In 2018 teachers contributed 704 percent of their salary to the pension fund while the state contributed 1199 percent. While potentially taxable on your federal return these arent taxable in Idaho. Nine of the 13 states in the West dont have income taxes on Social Security.

That leaves Colorado Montana New Mexico and Utah. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old. Part 1 Age Disability and Filing status.

Most pension benefits are currently taxable on your Idaho state income tax return. Exceptions include Canadian Social Security benefits OAS QPP and.

Is Social Security Income Taxable

Social Security Benefits Big Cola Increase Due To Inflation Money

Social Security Who Is Receiving Checks For Up To 1 657 Today Marca

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

At What Age Is Social Security No Longer Taxed In The Us As Usa

13 States That Tax Social Security Income The Motley Fool

/GettyImages-144560286-577404875f9b5858752b6d6d-1a80d8ccaca4477c86b8b840a36f8868.jpg)

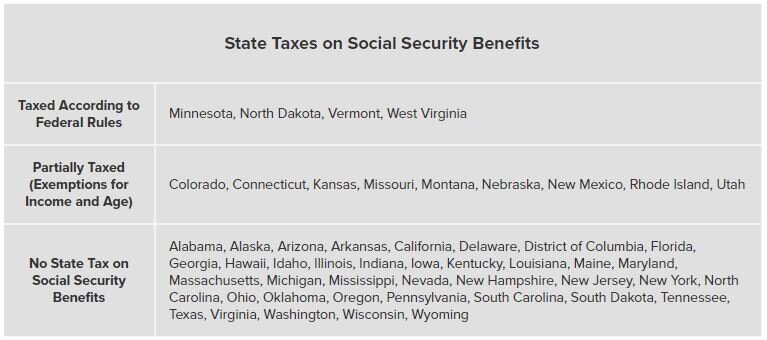

Which States Don T Tax Social Security Benefits

Taxability Of Social Security Benefits

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To

Proposed Legislation Would Expand Social Security Repeal Gpo And Wep

Idaho Affidavit Verifying Income Form Income Idaho Form

Common Law Marriage And Social Security

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

Are There Taxes On Social Security For Seniors Aginginplace Org

How Much Is The Average Social Security Benefit In Every State Simplywise

Social Security Disability Insurance Benefits Benefits Gov

Some States Tax Your Social Security Benefits

All The States That Don T Tax Social Security Gobankingrates

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group